Most category extensions struggle to perform because the execution disregards the principles of brand development and the realities of the consumer. When brand extensions stray too far or even a line extension pretends to be more, they result in lost relevance, a fractured brand image, and dilution of brand equity.

Many brands assume their existing brand carries automatic extension power. But in reality, it doesn’t. Your parent brand earns trust in one category. Stretching it into another means resetting the narrative by decoding the new category code and protecting what made you strong in the first place.

This article explains how to craft an effective category extension strategy to drive real growth. You will learn the critical factors that affect the brand extension into different categories and common mistakes you may face during the process.

Know where you belong and where you don’t.

Before launching into a new market, ask a simple question: Why do we belong here? That’s the difference between a brand stretching strategy with an apparent reason to win and one that ends in shelf clutter and consumer confusion.

A category extension means transforming an established brand into a new product category. In contrast, a product line extension expands your offerings within the category you already play in (think new flavors or pack sizes).

Most brands treat new markets as part of an automatic extension period, assuming that success in one aisle permits them to expand into another. But it’s earned through extensive market research, not internal belief.

Let’s break it down with two quick examples:

- Failure: Frito-Lay attempted to enter the beverage market with a lemonade product. Despite their dominance in salty snacks, consumers struggled to reconcile the brand identity with a sweet beverage, resulting in confusion and poor sales.

- Success: By partnering with Unilever, Hershey’s expanded the Reese’s brand into the ice cream category. The move capitalized on Reese’s strong brand identity and consumer loyalty, resulting in a successful brand extension that felt natural to consumers.

- Success: In partnership with Fire Brands, Mars Wrigley introduced Snickers™, Twix™, and Milky Way™ flavored chocolate milks. By maintaining the core taste profiles that consumers associate with these brands, the extension into the beverage category felt authentic and well-aligned with consumer expectations.

Start with clear insight.

The difference between a successful and unsuccessful brand extension often comes down to whether the decision was data-driven or gut-driven. Every innovative market strategy begins with a clear picture of where your brand is eligible to go and why it has a reason to win there.

That starts with understanding what your current consumers believe about you and how the new market segment sees the space you’re entering.

Behavioral research, category mapping, and usage and attitude studies help uncover the eligibility category for a customer franchise extension, not just where your product could be placed, but where your original brand has a credible chance of establishing a presence.

Data doesn’t always mean big budgets. There is a spectrum of insights, ranging from low-cost, high-impact observations to premium-level studies, and they all matter:

No-cost / Low-cost insights

- Search bar behavior on your site: What are people looking for when they land on your brand?

- In-store observations: What gets picked up and what doesn’t?

Even big brands often skip these. But they’re fast, directional, and cost almost nothing.

Mid-tier research

- Customer surveys: Ask your existing audience what they expect from you next.

- Retailer feedback: What are buyers seeing in a shift in shopper behavior?

- Category mapping: Identify areas of white space based on competitive saturation.

This level of insight ensures that your brand has permission to enter a space, not just ambition.

Premium data sources

- Quantitative U&A studies: Deep dives into needs, triggers, and barriers.

- Category purchase drivers: What motivates customers to buy a product?

- Vertical extension diagnostics: Can your original brand stretch upmarket or downmarket without losing clarity?

- Customer franchise extension testing: Will consumers accept your branding in a new category?

These are especially useful when preparing for major launches, retailer sell-ins, or a renewal application of your brand’s relevance in a crowded aisle.

Equity transfer is earned, not given.

Just because consumers trust your original brand in one category doesn’t mean they’ll follow you into another. That’s the brutal truth behind so many failed horizontal brand extensions. Borrowing your brand’s equity only works if the new context makes the same promise.

When you expand into a new category, your product extension strategy must introduce the latest offering and make a new promise that is still consistent with the brand they know and love.

Equity transfer depends on three things:

- Consistency of value: Your core promise must hold up in the new space. A brand known for affordability won’t be trusted in a premium tier without a narrative shift. Your marketing strategy must make that connection explicit.

- Relevance of reputation: Equity only transfers if consumers see the reason. If your original brand is trusted in functional beverages, entering salty snacks might confuse more than convert.

- Adaptability of execution: Your design system, messaging, and packaging architecture must evolve to fit the new category’s visual and verbal codes, while still maintaining your brand identity. That’s particularly essential when choosing between sub-brand and brand extension options.

Align your strategy with the consumer adoption curve.

Where your product lives on the consumer adoption curve determines how you build, message, and launch your CPG brand extension. A category’s maturity influences whether you need to lead with education or differentiation; getting that wrong can render even the best concept ineffective.

In a nascent space, you’re marketing a new product and validating the category. Consumers may not yet understand why it exists, let alone why your brand belongs. That means your brand extension strategy must do more than inform. You must sell the why before you sell the what.

- Category education: Explain the category’s role in solving consumer pain points. Clarity lies here at the foundation of long-term loyalty.

- Building trust through influencers and advocates: Early adopters are validators. Partnering with respected voices in your niche helps accelerate adoption and reduce friction.

- Simplified messaging: Focus on one core benefit. In early-stage categories, complexity is a conversion killer. Use language that gets to the point and helps consumers say, “I get it. I need it.”

This is where innovation platform development becomes critical. You’re laying the groundwork for a portfolio that grows with the category.

Design for the new shelf.

When your brand enters a new category, it also enters a new mental space for the shopper. Consumers evaluate your product in the context of everything else on that shelf, under new expectations, clues, and competitive pressures. That means your packaging design for your current line has to perform like a native in a new retail ecosystem.

Your design must strike a balance between distinctiveness and cohesion. Yes, it should reflect your core brand identity, but it must also respond to the norms and visual patterns of the new category. What works in beverages doesn’t work in frozen meals. Shoppers scan for entirely different things; if your pack doesn’t show up with the right cues, it gets ignored.

Each category has its own “rules of relevance, ” whether ingredients, claims, certifications, or usage cues. You can’t assume your existing messaging order translates. What was a hero feature in your original category might be meaningless or confusing somewhere else.

Optimizing the messaging hierarchy involves understanding how consumers scan, filter, and make decisions in seconds. What comes first? What can wait? What must go?

Test it like it’s real.

When a brand expands into a new market, consumers evaluate it in real-time. Recognition alone won’t carry you. Every decision, positioning, messaging, and packaging must be proven to the people who matter: the shoppers in that category. An effective product extension strategy uses an iterative test-and-learn approach backed by real data.

Start with brand stretch tests to validate if your established brand has credibility in the new product category. Follow with messaging diagnostics to prioritize what shoppers respond to. Utilize purchase intent testing with large, category-specific samples to predict behavior, rather than opinions.

Many unsuccessful brand extension efforts happen because teams rely on assumptions or outdated research. That’s especially risky in brand licensing or entering an eligibility category far from your original brand’s core. Market research must reflect how people think and buy at the shelf, not how teams believe in a boardroom.

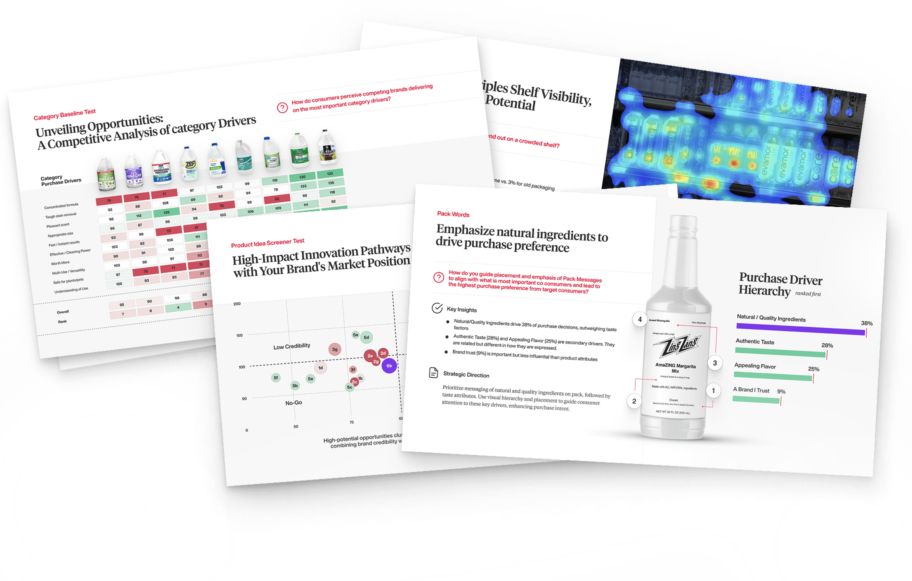

Path to Performance™

Taking a results-obsessed approach to CPG package design.

Learn how SmashBrand’s proprietary process – rooted in scientific principles, informed by data, and validated by your target audience – takes the guesswork out of package design and delivers guaranteed results.

Build category extension into your architecture.

Start by defining the extension’s role: Is it a hero, a support SKU, or a segment builder? That decision guides everything from naming to design. If your core brand equity is substantial, lead with the parent brand. If not, consider a sub-brand to manage risk and signal a difference.

Align variant naming with your existing structure to enable shoppers to navigate quickly. Utilize SKU logic to maintain pricing ladders, prevent duplication, and avoid overlap with existing products. Every new item must reinforce the broader portfolio, not disrupt it.

A well-structured brand architecture ensures the extension feels like a strategic evolution, not a bolt-on. Shoppability, clarity, and growth potential are the filters for every decision. It shouldn’t go to market if it doesn’t fit cleanly into the system.

Why most category extension strategies fail.

A successful brand extension is a natural next step rather than a forced leap. Brand teams sometimes confuse internal confidence with market readiness, leading to the introduction of new products into categories where they do not belong. This confuses consumers, loses brand loyalty, and weakens brand positioning.

To avoid brand dilution and protect the integrity of your core brand, you need a category extension rooted in data, not assumptions. Below are the four most common and costly pitfalls that derail even the most promising ideas.

Mistaking relevance for permission.

Just because a category is relevant to your consumer doesn’t mean your brand has earned the right to win. A brand extension strategy must consider the overlap in consumer needs and the brand’s fit in that space.

A skincare brand moving into supplements might see an adjacent opportunity, but if the brand name doesn’t carry health trust, it risks rejection. Consumers must grant permission, and that only happens when the extension feels like a logical evolution of the core brand, not a leap. Without that, relevance becomes a liability.

Relying too much on brand equity without validation.

Substantial existing brand equity can open doors, but it’s not a shortcut to success. One of the most common mistakes is assuming the awareness and loyalty built through an existing product will automatically carry over into a new category.

A successful brand extension requires rigorous validation, including consumer testing, competitive benchmarking, and positioning studies that demonstrate the brand strategy remains effective in a new context. Without this, you’re not building on equity, but gambling with it.

Creating “me-too” products with no clear point of distinction.

Category extension doesn’t mean just filling the shelf space. It expands the brand’s ability to deliver unique value. Copycatting competitors with a similar product line extension under your brand name might seem safe, but it’s rarely effective.

If the new product doesn’t offer a reason to believe or switch, it adds clutter and undermines brand awareness. A great brand extension strategy begins with a question: What makes this product distinctly ours? Without that answer, you’re just playing defense.

Internal momentum vs. consumer reality.

It’s easy to fall in love with an idea internally. The meetings, the prototypes, the cross-functional alignment, all signs point to “go,” but inside-out thinking kills more extensions than the competition ever could.

The real test of a brand’s stretch potential is what consumers do. Brand loyalty won’t save a new product if it doesn’t resonate in the real world. An effective brand strategy means looking beyond internal momentum and facing consumer reality with brutal honesty.

Nice Package

Don’t miss out on our monthly newsletter Nice Package!

Each month, we deliver a data-driven newsletter directly to your inbox, unpacking a critical topic in the FMCG & CPG industry.

"*" indicates required fields

Data-Driven Brand Development

Looking for a packaging design company that delivers more than promises? SmashBrand integrates strategy, testing, and design to create packaging that wins at shelf and accelerates sales. We back it with data and a guarantee. Don’t gamble with your brand. Choose a partner obsessed with performance.

Subscribe to

Nice Package.

A monthly newsletter that unpacks a critical topic in the FMCG & CPG industry.

Free Resource.

CPG product repositioning guide.

Explore the five undeniable signs your CPG product needs repositioning along with strategies for leveraging consumer insights for a guaranteed market lift.

Learn More About CPG product repositioning guide.