Most brands fall short of initial performance expectations. Spending years perfecting their product—tweaking formulas, refining ingredients, adjusting packaging—only to launch and fail. Why? In CPG and retail, it’s not the product that wins first; it’s the brand. Consumers don’t buy based on specs but on connection, trust, and instant recognition. Without a strong brand, even the best consumer packaged goods collect dust on shelves.

Winning as a CPG brand isn’t just about selling a product but mastering the entire ecosystem. From crafting a retail strategy that drives demand to optimizing retail media and fine-tuning the supply chain, every detail impacts the customer experience. The brands that thrive build consumer loyalty before they make a sale.

This guide cuts through the noise. In it, you’ll discover how successful CPG companies create dominant brands, how to position consumer goods for real-world success, and why aligning every touchpoint—from branding to retail strategy—is the only way to win.

The CPG and retail relationship.

The relationship between CPG brands and retail is a high-stakes game. Winning isn’t just about making a great product; it’s about proving that your brand can perform where it matters: on the shelf. Retail success isn’t a guarantee. It’s earned.

What makes CPG and retail different?

At its core, CPG brands create products while retailers sell them, but the dynamics is far more complex. CPG companies control branding, product innovation, and consumer engagement, while retailers determine what gets stocked, how much space a brand receives, and whether it stays on the shelf.

Retailers aren’t just looking for great products. They want:

- Brands that drive traffic and increase category growth.

- Products that sell consistently—if something doesn’t move, it’s replaced fast.

- Proof of consumer demand—data that shows the product will perform.

For a CPG brand, simply getting into retail isn’t enough; you need a strategy to stay there.

Retail is the make-or-break point for CPG brands.

Shelf space is limited, expensive, and highly competitive. Landing a retail placement is insufficient—your product must justify its presence daily. If your brand doesn’t drive sales, it’s out, and the opportunity goes to a competitor.

Retailers don’t hesitate to pull underperforming products because:

- They continuously optimize shelf space for profit

- New products are always knocking at the door. If your product is underperforming, a line of brands is waiting to take its place.

- Retail resets happen regularly.

So, how do you win in retail and avoid the “one and done” trap? The approach depends on where you’re starting from:

Building a new brand for retail.

If you’re launching a brand-new CPG brand with retail in mind, the key is to build demand before you even hit the shelves. Retailers don’t take chances on unknown brands. They take chances on brands that prove they can drive velocity.

- Start with a data-backed brand strategy. Positioning and packaging must be built around what real consumers want, not what you assume will work.

- Test before you launch. Don’t let retail be your testing ground. Use consumer testing, retail simulations, and digital validations to refine your messaging and design.

- Develop a multi-channel retail strategy. A brand that performs in multiple retailers (not just one) is a safer bet for buyers looking for scalable winners.

You have a great product idea, and you’re considering retail.

Retail is about brand strength, positioning, and execution. Before you leap, ask yourself:

- Does your brand have a precise positioning? If it’s just a product with no larger brand story, it’s harder to compete.

- Can you prove demand before pitching to retailers? Retailers don’t want to test your product; they want to sell it immediately.

- Is your packaging optimized for the shelf? A great product will fail if it doesn’t catch attention and communicate value within seconds.

The best move is to test your concept in DTC, online retail, and independent stores first. Retail buyers love brands with built-in consumer demand, as it makes their jobs easier and lowers the risk of a failed launch.

You’re a DTC brand ready to expand into retail.

If you’ve built a strong DTC brand and are now looking to break into retail, you have a big advantage but also face new challenges. While DTC allows for controlled storytelling and direct consumer engagement, retail is about:

- Competing at the shelf with limited space and no brand-controlled sales funnel.

- Mastering retail media to create demand inside and outside of the store.

- Aligning your supply chain to meet unpredictable retailer demands.

Key success factors for DTC brands entering retail:

- Retail pricing strategy—What worked in DTC won’t necessarily work in a retailer’s pricing model.

- Merchandising and shelf placement: Retail success is about visibility. You lose if your product isn’t easy to find and shop for.

- Proof of velocity: Retail buyers want data showing your brand is widespread and converts sustainably.

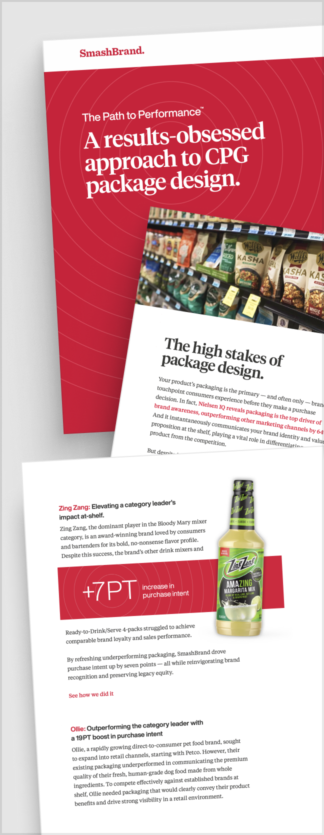

Path to Performance™

Taking a results-obsessed approach to CPG package design.

Learn how SmashBrand’s proprietary process – rooted in scientific principles, informed by data, and validated by your target audience – takes the guesswork out of package design and delivers guaranteed results.

"*" indicates required fields

What drives success in CPG and retail?

Success in the Consumer Packaged Goods (CPG) industry hinges on a trifecta of components: a data-driven brand strategy, retail-ready packaging design, and a relentless focus on sales velocity. Let’s examine each component to understand how they collectively drive performance in the competitive retail industry.

Data-driven brand strategy.

In today’s market, intuition alone is insufficient. Brands must harness data to inform their marketing strategies. Companies can tailor their messaging to resonate deeply with their target audience by analyzing consumer behavior and preferences. This approach ensures the brand’s value proposition stands out amidst the noise. For instance, a comprehensive retail product audit can reveal insights into purchasing patterns, enabling brands to refine their consumer targeting.

Retail-ready packaging design.

Packaging serves as a brand’s silent ambassador on retail shelves. It’s imperative that packaging not only captures attention but also communicates the product’s benefits instantly. A study published in the Journal of Marketing Research found that innovative packaging can increase revenue by up to 12.8%.

Moreover, pre-launch testing of packaging designs can eliminate subjectivity, ensuring that the final product aligns with consumer expectations and maximizes impact. This proactive approach reduces the risk of costly redesigns post-launch.

Sales velocity over shelf presence.

Securing shelf space is just the beginning; maintaining it requires consistent sales performance. Retailers prioritize products that demonstrate substantial sales velocity. If a product lingers without movement, it’s swiftly replaced. Incremental sales growth is a key determinant of long-term success in the CPG sector.

Effective supply chain management plays a crucial role here. Ensuring product availability without overstocking helps maintain optimal inventory levels, supporting sustained sales momentum. Additionally, fostering brand loyalty through exceptional customer service can lead to repeat purchases, further enhancing sales velocity.

The challenges holding brands back.

Several challenges can impede a brand’s success in the CPG landscape. Let’s examine these obstacles and explore strategies for overcoming them.

Failure to validate concepts before retail launch

Many brands make the critical mistake of relying solely on internal opinions during the development phase of their specialty retail products. As a result, 95% of new products fail. Without rigorous consumer testing, assumptions about consumer preferences can lead to products that falter in the market. This oversight often results in weak retail performance and eventual delisting from retail stores.

Solution: Implement comprehensive consumer testing protocols. Engage in social listening, shopper data, and consumer testing, and pilot programs to gather actionable customer data. This approach ensures that the product aligns with market demands and reduces the risk of failure upon launch.

Retail buyers demand proof, not promises.

Securing shelf space in today’s retail landscape requires more than persuasive pitches; it demands concrete evidence of anticipated product success. Retail buyers seek data-driven assurances that a CPG product will resonate with consumers and drive sales. Without such evidence, gaining entry into retail channels becomes a formidable challenge.

Solution: Develop a robust marketing strategy backed by empirical data. Utilize market research to demonstrate consumer interest and projected sales performance. Presenting a compelling case with solid data can significantly enhance credibility with retail companies.

The disconnect between strategy, design, and testing.

A common pitfall for CPG brands is the fragmented approach to product development. Collaborating with multiple agencies for strategy, retail packaging design, and testing can lead to misalignment. These disjointed efforts often dilute the overall impact, resulting in products that fail to meet consumer expectations.

Solution: Adopt an integrated approach to product development. Ensure seamless collaboration between strategy formulation, design execution, and testing phases. This cohesive methodology fosters consistency and enhances the product’s appeal to the target audience.

How to build a CPG brand that wins in retail.

Building a successful CPG brand that thrives in the retail environment requires a strategic and comprehensive approach. Below are the essential steps to guide you through the brand development process, ensuring your brand not only enters the market effectively but also sustains growth and captures significant market share.

Conduct effective market mapping.

Before creating a single product, designing packaging, and pitching to a retail store, one critical step determines whether an emerging CPG brand can win: market mapping. Effective market mapping pinpoints where your brand fits within the competitive landscape and identifies untapped opportunities. A well-executed market map reveals:

- White space opportunities: untapped consumer needs that competitors aren’t addressing.

- Key consumer trends: shifts in purchasing behavior that indicate where demand is growing.

- Competitive gaps: places where existing brands are underperforming or missing the mark.

Market mapping starts with the right brand development questions—deep, strategic inquiries that uncover where and how a brand should position itself. A few key questions include:

- Who are the dominant players in the space, and what do they do well?

- Where are consumers underserved or unsatisfied?

- How is the category evolving based on shifting consumer trends?

- What pricing models work, and how do retail buyers evaluate new brands?

The answers to these questions shape a product and an entire brand development strategy that aligns with market realities.

Develop a unique value proposition.

A clear value proposition ensures differentiation and long-term success for emerging CPG brands. Brands must clearly understand the target consumer behavior and create a compelling reason for consumers and retail partners to choose their brand. To craft a unique value proposition, companies must first identify white space opportunities in the market.

Analyze competitors and consumer demand to reveal gaps where your brand can stand out. This requires in-depth research into customer behavior, purchase drivers, and unmet needs. The next step is to design with functionality. A well-crafted design reinforces brand messaging. Packaging must instantly communicate your product’s unique benefits while balancing branding and inventory management considerations for retail efficiency.

Retailers prioritize brands that guarantee sales growth and smooth operations. Backing your positioning with data-driven sales projections and a streamlined supply chain makes securing partnerships with financial services providers and retail partners easier.

Develop the brand identity.

A well-crafted brand identity drives CPG sales and builds lasting connections with consumers. It starts with brand development in marketing and ensures consistency across packaging, messaging, and retail execution.

Successful product brand development begins with precise positioning. Archetype development helps shape the brand’s personality, guiding tone, visuals, and storytelling. Brands must align with consumer insights to create a compelling message. Understanding what motivates shoppers increases customer satisfaction and brand loyalty.

In a physical store, packaging must stand out and communicate benefits instantly. In CPG marketing, digital assets must reinforce the brand identity and drive engagement. Industry experts help fine-tune branding for better market impact. Strong marketing efforts across channels ensure consistency, leading to higher CPG sales and retail success.

Test concepts with real consumers.

Skipping consumer testing leads to failed launches and wasted budgets. Real consumer insights reveal whether a product’s pricing strategy, packaging, and messaging connect with shoppers before it hits shelves. Testing removes the guesswork and refines the brand before costly mistakes happen.

Effective CPG marketing starts with direct feedback. Surveys, focus groups, and in-store simulations show how consumers react to packaging and messaging in a physical store environment. If a product fails to grab attention or its benefits are unclear, retailers can make adjustments before rejecting it.

Price perception matters. Testing different price points identifies what shoppers are willing to pay while balancing brand value and customer satisfaction. If the price is too high, sales will be lost, and if it is too low, credibility will be eroded.

Integrated marketing efforts and consumer testing create data-driven confidence. Brands that validate concepts before launch gain the trust of retail buyers, reduce risk, and enter the market with a ready-to-perform product.

Optimize for retail and supply chain efficiency.

A CPG product must be retail-ready before it can be sold. Retailers expect brands to align with their logistics, shelving requirements, and category goals. Ignoring these factors creates roadblocks that keep products out of stores.

A seamless brand development process ensures packaging fits standard shelf dimensions, reduces waste, and supports efficient stocking. Retail companies favor brands that streamline operations, making their job easier. It gets rejected if the packaging is oversized, challenging to display, or prone to damage.

Understanding the retail landscape helps brands anticipate distribution challenges and plan accordingly. An innovative product branding strategy means designing for visual impact and storage efficiency. Retail buyers look for products that ship efficiently, stack well, and maintain appeal at scale.

Leveraging consumer trend data and real-time customer data optimizes inventory flow. A well-managed supply chain prevents stockouts and overproduction, ensuring brands stay competitive. Retail companies prioritize efficiency, and brands that deliver on it secure better shelf space and long-term success.

Launch and iterate.

Getting onto shelves is only step one. A brand that doesn’t track performance or adapts to market shifts will not last. Every launch should be a learning opportunity, with real-world data guiding the next move.

Sales velocity, shopper engagement, and retail sell-through rates reveal what’s working and what’s not. Retailer feedback, consumer reviews, and in-store observations provide critical insights that refine positioning, messaging, and packaging. A product might need a pricing adjustment, a design tweak, or more substantial promotional support to maximize its impact.

Winning brands don’t assume success—they measure, adjust, and improve. They stay ahead of category trends, optimize based on consumer behavior, and ensure their product remains relevant. Retail environments are dynamic, and brands that embrace iteration strengthen their market position.

Subscribe to

Nice Package.

A monthly newsletter that unpacks a critical topic in the FMCG & CPG industry.

Free Resource.

CPG product repositioning guide.

Explore the five undeniable signs your CPG product needs repositioning along with strategies for leveraging consumer insights for a guaranteed market lift.

Learn More About CPG product repositioning guide.