Consumer behavior is constantly evolving, and a brand’s identity plays a critical role in capturing attention and driving sales. Retailers are regularly reassessing their shelves, making strategic decisions about which products stay and which ones go. At the same time, consumers are continuously exposed to new brands, creating opportunities for trial and adoption. In this dynamic landscape, standing out isn’t just an advantage—it’s essential.

CPG brands without a strong identity that attracts and drives memorability are at risk of losing share during this season. So in this short article, we unpack the correct use of logos and brand assets on the PDP to ensure standout is more than momentary and carries over to new channels and competitive sets.

The Role Of Brand Identity On Pack

Whether it’s a core or niche category, brand logos matter. With the majority of consumers identifying as omnishoppers, products that lack identifiable branding become forgettable and replaceable. But there’s a lot more to it than simply allocating 50% of the PDP to the brand logo; it requires a more robust strategy that begins with a full diagnosis. Here’s what to assess:

The Product Category

The necessity of logo identity varies significantly across different categories. Those with low differentiation rely heavily on strong branding to distinguish products, as the inherent features offer little variance to influence consumer choice.

Conversely, in highly differentiated categories, where products inherently possess unique attributes or innovations, the intrinsic characteristics of the products themselves often play a larger role in consumer decision-making.

Emerging categories often require more extensive explanation and education to help consumers understand the new products’ benefits and uses, thereby necessitating more detailed claims and supportive branding to foster adoption.

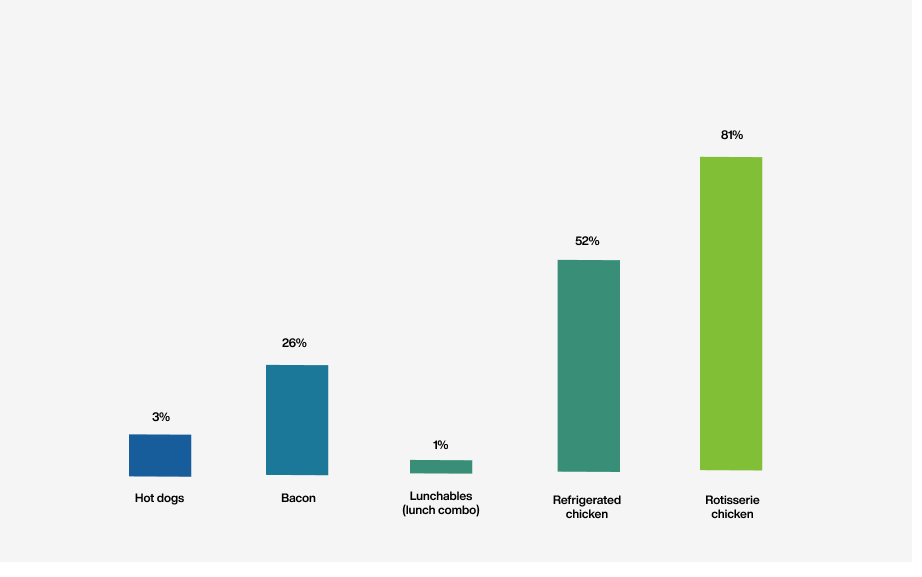

In assessing the role of branding, consider the market share held by private label. This can be a strong indicator of whether branding will be effective in consumer purchasing decisions. Categories with a higher prevalence of private label products often suggest a competitive environment where distinctive, strong branding could play a critical role in differentiating a branded product but could have a minimal impact since such a small share is owned by brands. Here’s a sample list of private label category share.

In a category such as hot dogs, consumers do not trust private label quality and are highly influenced by products from brands they can identify and align with. In the case of rotisserie chicken, 19% leaves little room for category penetration and would require a very distinct USP.

The Retail Channels

The strength of brand identity is important for all channels but more so for retailers with limited brand opportunity and frequent brand turnover (such as Costco). Specific retailers are more interested in carrying the latest categories than generating repeatable sales for the same products.

This stresses the importance of building memorability with your brand identity. When performed correctly, the omnichannel shopper is likely to continue the purchasing habit even when big box stores abruptly discontinues the SKU.

Additional Brand Assets

Both for emerging and “forgotten” brands, logos may need support to build enough memorability to stimulate repeat purchase or drive consumers back to the brand. While the logo is likely your hero design, having other recognizable assets such as brand characters and distinct product photography encourages greater resonance and recall.

Assigning a brand identity hierarchy for your product also helps to establish and showcase what’s most unique and stand out on shelf, creating a findable presence no matter the channel and competitors.

⸻

*The hierarchy will differ based on category, competitors, and brand positioning. Ultimately, design testing determines the most impactful hierarchy.

Design Diagnostic Testing

Discover the optimal balance of brand identity and product claims on your product’s front panel with our design diagnostic testing services. By leveraging objective KPIs and the insights of over 800 targeted consumers, we focus on how your brand’s presence influences customer perception and purchase decisions. This process not only reveals the key drivers and barriers but also highlights untapped potential within your packaging design.

How To Approach Brand Identity Placement

Current Market Status

If your brand isn’t already the go-to category option, drive product trial by emphasizing claims and visuals. In retail where you only have a few seconds to capture attention, the focus should shift away from the logo. Instead, highlight the product itself, its unique claims, and the compelling visuals that accompany it.

⸻

How much front panel space a logo should own is a question we consider for every project. In the packaging strategy, we determine where branding exists in the hierarchy and test to validate our assumptions.

Distinction (not easily duplicatable)

How can you build a brand that is not easily duplicated? It’s a tough question to answer but must be considered since private label and “race to the bottom” brands are constantly trying to steal share.

⸻

Source: https://www.linkedin.com/pulse/who-copycat-kings-branding-matt-baron/

*Percentage indicates error rate due to Misattribution

Building a brand that endures goes beyond just logo placement—it’s about strategic differentiation that drives consumer preference and loyalty. Brands that fail to optimize their identity risk being overlooked or, worse, mistaken for competitors. By leveraging design testing, refining brand asset hierarchy, and understanding category dynamics, you ensure that your packaging isn’t just another option on the shelf—it’s the unmistakable choice. The question isn’t just how much space your logo should take up; it’s whether your brand is positioned to win in this omnichannel landscape, where recognition, recall, and relevance determine long-term success.

Subscribe to

Nice Package.

A monthly newsletter that unpacks a critical topic in the FMCG & CPG industry.

Free Resource.

CPG product repositioning guide.

Explore the five undeniable signs your CPG product needs repositioning along with strategies for leveraging consumer insights for a guaranteed market lift.

Learn More About CPG product repositioning guide.